Annuities | Guaranteed Lifetime Income

Scared of a recession? Negative returns with stocks? Want some fixed income that isn’t a roller coaster ride? Let’s talk about annuities. Some are paying higher interest than CDs (certificate of deposit) and bonds.

Annuities are insurance products guaranteeing income for life or over a fixed timeframe. They can either be immediate or deferred annuities. Immediate annuities are funded with one lump sum with the contract owner receiving immediate supplemental retirement income while deferred annuities grow tax deferred.

Video Overview:

Four main annuity types are:

Fixed annuities

tax-deferred growth

Payout as lump sum, over a set period of time, or for life

Subtype: Multi-Year Guaranteed Annuities (MYGA)

Fixed yield over a specific number of years, then allows for renewal at new rate

Fixed indexed annuities

Similar to fixed but tracks market index like S&P500

Returns are capped but there is a guaranteed minimum (0% to 2% so never negative)

SPIA (Single Premium Immediate Annuities)

Funded with one lump sum (maybe from a 401k)

If funds are from a

qualified SPIA (funded with pre-tax dollars), 100% of the income payments taxed as ordinary income

non-qualified SPIA (post-tax like Roth IRA), the income payments will contain some non-taxable portion (as decided by an exclusion ratio).

Immediate income stream with different payment options: guaranteed payments for life, for a set guaranteed period, or both.

Variable annuities

Rates based on the performance of an underlying portfolio

More Benefits to Annuities

Fixed annuity death benefit to beneficiary (may be taxable)

Long-Term Care Waiver: penalty-free access early if need long term care such as a nursing home

Terminal / Chronic Illness Waiver

Many annuities are protected from creditors

Fees

Withdrawal (or surrender) charges for cancelling or trying to withdraw the money early.

Usually there is some liquidity, for example, you may be able to withdraw 10% after the first contract year penalty free

Annuitant (person receiving annuity income payments) charged 10% early withdrawal penalty from the IRS if under 59 ½.

Optional Riders such as Long-Term Care Waiver

Fixed Annuity Advantages

Guaranteed interest rate (for fixed annuities)

Tax-advantaged growth

Example of tax deferred return on $100,000 Five year MYGA compounded yearly with 5% fixed interest

$100,000*(1.05)^5=$127,628.156 (No tax paid during the 5 years)

After the 5th year and a 22% federal tax, your return is 27,628.156*(1-0.22)+$100,000 principal=$121,549.96

However, if you had no tax deferral and a 22% federal tax bracket applied every year for 5 years (rather than at only the end) and 0% state tax: you would earn [$100,000*1.05-$100,000*(.05)*0.22]=$103,900 in the first year rather than $105,000 in tax deferred growth

After 5 years of 5% compounding and 22% tax, you only have $121,081 which is $468.96 less than in the tax deferred growth or a $468.96/(100,000)*100=0.47% less return

The higher your tax bracket and the longer your term, the more pronounced the difference in growth

This does not consider the fact that you may be able to do a 1035 exchange into another annuity and keep deferring tax. This also does not take into account that you might be pushed into a higher tax bracket since all your gains are deferred to one year although you might decide to do a different payout than a lump sum distribution. One alternative would be annuitizing the payout, so you could withdraw guaranteed monthly payments over a set timeframe such as over 5 years.

Nice calculator here to test the effect of different tax rates. Another calculator here to find the rate.

Guaranteed income (possibly for life)

Some liquidity

Not FDIC insured but all insurance companies are part of state guaranty association that insures your money if insurance company goes under

Coverage is different for each state but usually at least $250,000.

Fixed Annuity Disadvantages

Lower return (often similar to CDs)

Compared to 50 year average of S&P500 with dividends reinvested: 10.331%

Surrender charges (limited liquidity)

10% IRS Penalty for those with withdrawals before age 59 ½

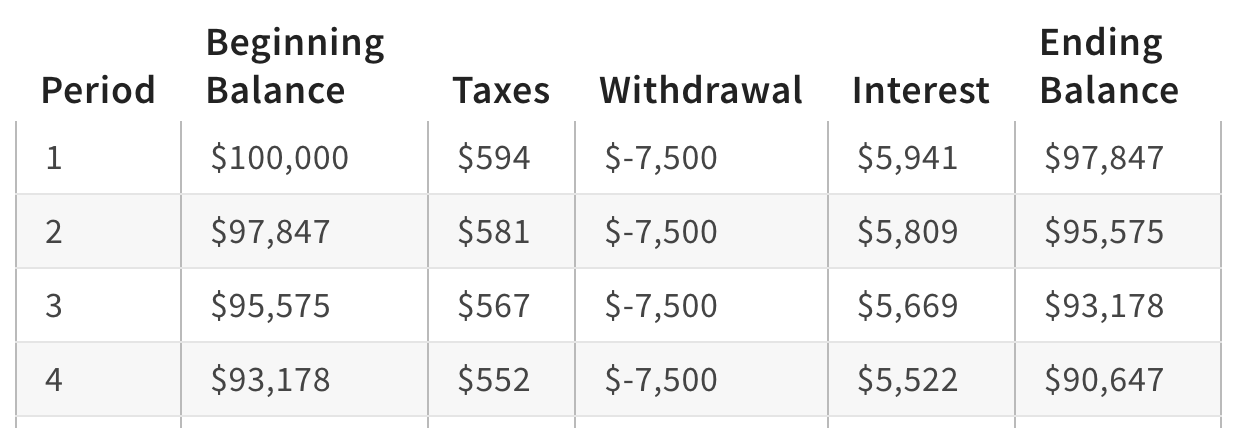

Lifetime Income Example

Living benefit riders guarantee a defined payout while annuitant is alive

Example:

Initial Annuity Contract Value: $50,000 (principal)

Guaranteed living benefit rider: 0.95% annual fee of contract value

Assume first year growth is $50,000*1.07177=$53588.5

$53588.5*0.0095= $509.09 rider fee

After 10 years, principal grew to $90,000 (6.054% annual growth)

But let’s say there is a minimum income base of 200% of eligible premiums if you wait at least 10 years before withdrawing, meaning you are guaranteed at least $100,000

Gross Income Credit Percentage of 7.5%

Thus, with this rider, you are guaranteed at least 100,000*0.075=$7,500 every year in income for the rest of your life.

Comparison calculator:

Your money is projected to last approximately 18 years with systematic withdrawals totaling $136,439. (I have $ 100,000 in savings, earning an average annual return of 4 % before taxes. I plan to withdraw $ 7,500 each year and may increase my withdrawal amount by 0.0 % every year. My federal marginal tax bracket is 10%). Annuity may be a good choice if you live longer than 18 years but this is highly dependent on your tax rate and yield. Consider as well that there may be an added death benefit to beneficiaries.

6% growth: Your money is projected to last approximately 24 years with systematic withdrawals totaling $177,199.

Compare annuity interest rates

Remember to filter by your state

What to look for when comparing annuities?

Look for higher AM Best Rating: “A letter grade (from A++ to F) assigned by globally recognized A.M. Best Rating Services to indicate their opinion with regard to the issuing insurance company's financial strength and ability to pay claims.”

Minimum Premiums

Years (lockup)

Penalty Free Withdrawn Percentage: “The amounts specified in an annuity contract that can be withdrawn on a penalty free basis, even during the time in which the annuity is subject to early surrender charges.”

Interest/Yield

Read the contract for more

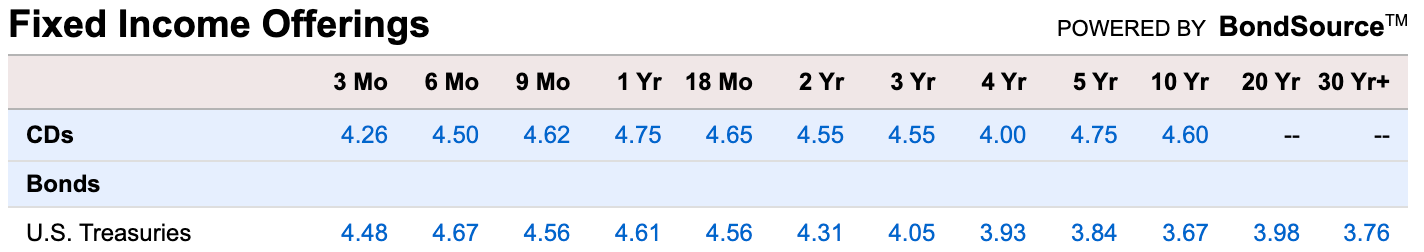

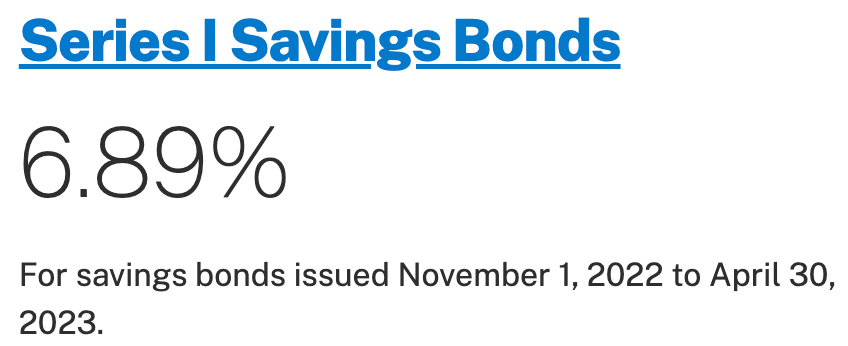

Compare to other fixed income investments

As of 12/22/2022, the 5.51% Yield for the MYGA Plus 5 is higher than CDs and Bonds but lower than Series I Savings Bonds (I Bonds have a variable rate depending on CPI-U)

Disclaimers:

All content is for entertainment purposes only and should not be construed as financial or investment advice. Links or hyperlinks referenced are hopefully good sources of information, but if they are wrong, let me know by commenting below, so we can all avoid misinformation.

I may from time to time include referral links that that help financially support me. Referral offers and information provided are accurate at the time of the posting date but may not be so in the future.